- Understanding Your Home Electrical Insurance

- Homeowners Insurance Limitations Covering Electrical Problems

- Homeowners Insurance to cover Faulty Wiring

- Electrical Panel Replacement and Homeowners Insurance

- Home Electrical Insurance FAQs

- Does homeowners insurance cover electrical problems?

- What is usually excluded from typical homeowners insurance coverage for electrical issues?

- Will insurance cover old wiring?

- Does homeowners insurance cover electrical panel replacement?

- Which electrical panels are uninsurable?

- Does house insurance cover fuse box replacement?

- Electrical Services Company Near Me

As a responsible homeowner, you diligently pay your insurance premiums to protect what is likely your most significant investment – your home. However, when the time comes to make necessary electrical repairs or electrical upgrades, you may find yourself wondering, “Does home insurance cover electrical problems?” The answer, as with many insurance-related questions, is not always straightforward.

At Palmer Electric, we have been a leader in the electrical industry for over 70 years, providing expert electrical re-wiring, upgrades, and repair services to homeowners throughout Orlando and Central Florida. In this guide, we aim to illuminate the often-murky waters of insurance coverage, delving into the nuances of what is commonly included, what is frequently left out, and the various scenarios in which your insurance may or may not step in to provide financial relief when homeowners insurance cover electrical problems or home insurance cover electrical problems.

Understanding Your Home Electrical Insurance

A standard homeowners insurance policy is designed to provide financial protection against sudden and accidental damages to your home, including its electrical systems and wiring. This coverage typically extends to damages caused by specific perils, such as:

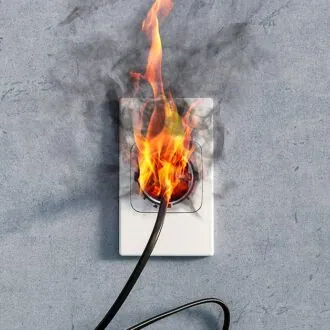

- Fire: One of the most common perils covered by homeowners insurance, fire damage can be devastating to your home’s electrical system. Whether caused by an electrical malfunction, a kitchen accident, or an external source like a wildfire, your insurance policy will typically cover the costs to repair or replace damaged electrical components as a result of a fire.

- Lightning strikes: When lightning strikes your home, it can cause significant damage to your electrical system, including short-circuiting appliances, damaging wiring, and even starting fires. Homeowners’ insurance policies generally cover electrical damage caused by lightning strikes, which can be particularly important in areas prone to severe thunderstorms.

- Falling objects: If a tree or large branch falls on your home during a storm, it can cause extensive damage to your roof, walls, and electrical system. Homeowners insurance typically covers the cost of repairing electrical damage caused by falling objects, such as trees, branches, or other debris, as long as the cause of the falling object is a covered peril like wind or ice.

- Wind and hurricane damage: Orlando and Central Florida are no strangers to severe winds and hurricanes, which can wreak havoc on your home’s electrical system. Strong winds can topple trees, send debris flying, and even tear off roofing, all of which can lead to significant electrical damage. If your home’s electrical system is damaged due to high winds or hurricane-related perils, your homeowners’ insurance will typically cover the cost of repairs.

Does Homeowners Insurance Cover Electrical Wiring?

For example, if a severe thunderstorm causes a tree to fall on your home, damaging the electrical wiring, your homeowners’ insurance would likely cover the costs to repair the damage, up to your policy limits. Similarly, if an electrical fire were to break out, destroying your electrical panel, your insurance would typically cover the costs for a licensed electrician to make the necessary repairs. These are just a few instances where homeowners’ insurance covers electrical problems.

Homeowners Insurance Limitations Covering Electrical Problems

While homeowners insurance provides a financial safety net for many electrical issues, there are several electrical problems excluded. Most policies will not cover these electrical issues:

- Damages caused by wear and tear, age, corrosion, or lack of maintenance.

- Faulty workmanship, repairs, or installation.

- Circuit overloads.

It is essential to understand that homeowners insurance is not a maintenance plan. As a homeowner, it is your responsibility to properly maintain your electrical systems, address any issues promptly, and ensure that any repairs or installations are completed by licensed and qualified professionals. Regularly scheduled maintenance can help prevent issues that home insurance would cover as electrical problems.

Homeowners Insurance to cover Faulty Wiring

Homes built before the 1950s and 1970s often feature outdated wiring systems, such as knob-and-tube or aluminum wiring. While these systems were considered safe at the time of installation, they pose increased risks and do not meet current electrical codes.

Why are knob and tube wiring considered hazardous?

Knob-and-tube wiring, characterized by its lack of grounding, deteriorating insulation, and exposed wires, presents a shock hazard and increases the risk of electrical fires. Aluminum wiring, while more affordable than copper, is prone to loose connections and overheating, which can also lead to fires.

Does homeowners insurance cover faulty wiring?

Many insurance companies are reluctant to provide coverage for homes with these outdated or hazardous wiring systems. Some may refuse to insure the home altogether, while others may require an electrical inspection and upgrades before offering coverage. In some cases, insurance companies may provide coverage but at a higher premium to account for the increased risk.

Why is aluminum wiring considered hazardous?

Aluminum wiring is considered hazardous due to its physical properties and susceptibility to degradation over time. At Palmer Electric, we’ve seen the main hazard is a higher risk of electrical fires. When we inspect homes with aluminum wiring, he usually found arcing and overheating. Also, when aluminum is exposed to air, aluminum forms an oxide layer, which increases resistance and generates heat at connections. Over time, this oxidation can worsen the risk of fire.

Will insurance companies cover homes with aluminum wiring?

If your home has knob-and-tube or aluminum wiring, it is crucial to consult with your insurance provider to understand their specific requirements and to seriously consider upgrading to a safer, modern wiring system to ensure that your homeowner’s insurance covers electrical problems.

Electrical Panel Replacement and Homeowners Insurance

The electrical panel, also known as a breaker box, is the heart of your home’s electrical system, responsible for distributing electricity to all of your outlets and appliances. As homes age and electrical demands increase, panels can become outdated, posing safety hazards or failing to meet the needs of modern households.

Will insurance cover a new electrical panel?

In most cases, insurance companies will not cover the costs of upgrading an electrical panel simply because it is old or outdated. Coverage typically only applies if the panel is damaged by a covered peril, such as a fire or lightning strike. However, some insurance companies may require you to upgrade your electrical panel to maintain coverage, particularly if your home has a fuse box or a panel with recalled circuit breakers.

Does My Homeowner’s Insurance Cover Electrical Panel Upgrades?

If your insurance company mandates an electrical panel upgrade, they may offer financial assistance or discounts to help offset the costs. Be sure to check with your insurance provider to understand their specific requirements and any incentives they offer for electrical upgrades.

Home Electrical Insurance FAQs

Does homeowners insurance cover electrical problems?

Homeowners insurance typically covers sudden and accidental damage to your electrical systems caused by covered perils like fire, lightning, or falling objects. However, it generally does not cover wear and tear, lack of maintenance, or faulty workmanship.

What is usually excluded from typical homeowners insurance coverage for electrical issues?

Most homeowners insurance policies exclude coverage for damages caused by wear and tear, age, corrosion, lack of maintenance, faulty workmanship, repairs, installation, and circuit overloads.

Will insurance cover old wiring?

Many insurance companies are hesitant to cover homes with outdated wiring systems like knob-and-tube or aluminum wiring. They may require an electrical inspection and upgrades before providing coverage or charge higher premiums due to the increased risk.

Does homeowners insurance cover electrical panel replacement?

In most cases, insurance will not cover the costs of upgrading an electrical panel simply because it is outdated. However, if the panel is damaged by a covered peril, such as a fire, insurance may cover the replacement costs.

Which electrical panels are uninsurable?

Some older electrical panels, such as those with fuse boxes or certain brands of circuit breakers with known safety issues, may be uninsurable. Insurance companies may require you to upgrade these panels to maintain coverage.

Does house insurance cover fuse box replacement?

Most insurance policies will not cover the costs of replacing a fuse box with a modern circuit breaker panel unless the fuse box is damaged by a covered peril. However, your insurance company may require you to upgrade your fuse box to maintain coverage.

Electrical Services Company Near Me

Protecting Your Home and Your Investment

As a homeowner, it is essential to take a proactive approach to maintain and upgrade your electrical systems. Regular maintenance and timely repairs not only help to ensure the safety and efficiency of your home but can also prevent more costly issues down the line.

At Palmer Electric, we offer comprehensive homeowner electrical services, including inspections, repairs, rewiring, and electrical upgrades to keep your home’s electrical system functioning safely and optimally. Our experienced team of licensed electricians is dedicated to providing the highest quality service and workmanship, giving you peace of mind and protecting your most valuable asset.

If you need assistance with repairs or upgrades, do not hesitate to contact Palmer Electric. Call us today at 407-646-8700 or contact us online to schedule an appointment.